General, I’ve seen B2B startups get slightly higher at their monetary planning — however solely slightly. I nonetheless see a mix of (1) no actual plan in any respect, (2) woefully optimistic plans, and (3) plans that don’t tie the burn fee to the expansion fee. Tough stuff.

In order we head right into a New Yr, it’s time. To construct 3 pretty simple plans:

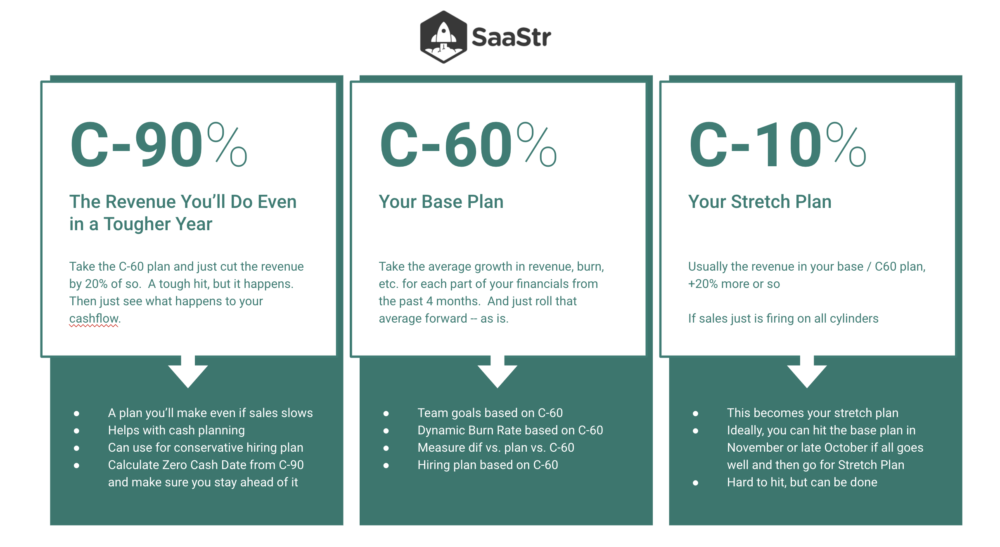

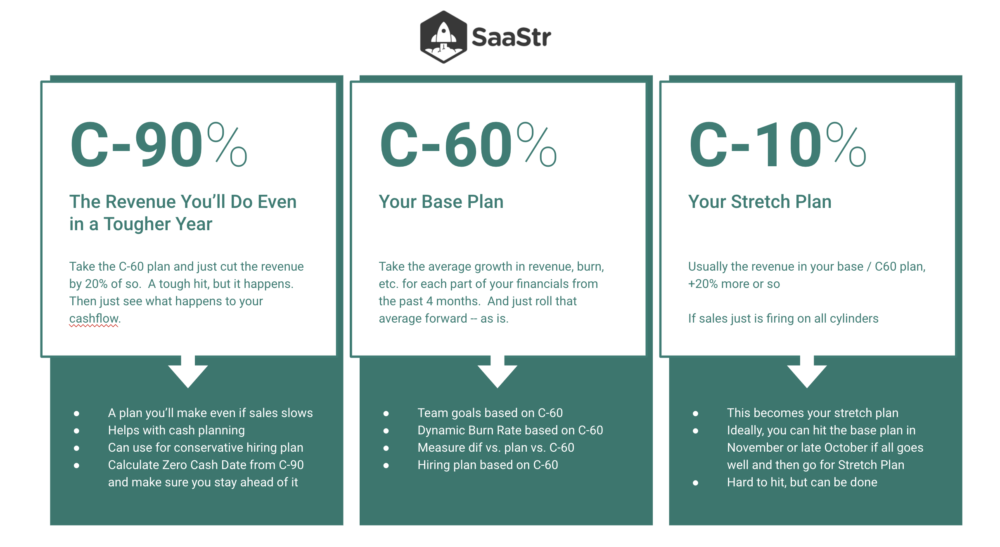

- Your base plan (C60)

- Your stretch plan (C10/20); and

- A “worst case” plan (C90)

C = Confidence You’ll Hit It

Do it proper, you’ll additionally find yourself with a extra considerate strategy to spending and burn charges as nicely, and extra.

I do know a lot of you haven’t began, or have solely completed a cursory job of monetary planning. That’s a mistake for a number of causes. First, with no robust, data-driven mannequin, your targets for subsequent 12 months might be a lot more durable to hit. Second, even small amounts of mis-spend and over-spend can compound over the course of the 12 months to a a lot greater burn fee. Extra on that here. And third, and most significantly, you have to know the way far to stretch. And not using a robust plan, doing even higher is simply … a hope. You received’t know the place to spend, what number of to rent, and what the plan for every month must be. Your workforce received’t know, both.

And in reality, you want three plans to run your SaaS enterprise for subsequent 12 months. Particularly nowadays, when enterprise capital is a lot tighter:

- A C-60 Plan. That is one you may have a 60% confidence fee you possibly can hit. C=Confidence. A lot greater, and also you aren’t pushing laborious sufficient. A lot decrease, and it’s too dangerous to plan round. That is your base plan. And one you possibly can virtually automate the primary draft of (see under).

- A C-10 Plan. This can be a variant of the C-60 plan that you just assume perhaps, simply perhaps, you possibly can hit. Often, it’s round 20% greater than the bottom / C-60 plan in SaaS. So in case your base plan is to develop 100% subsequent 12 months, your C-10 plan is usually 120% development. This turns into your stretch plan. A lot greater than 10%, and it’s too simple to attain. Any decrease, it turns into implausible. However you possibly can tweak this to C-15 or C-20 if you’d like. C-20 may make extra sense for these of you in a predictable groove.

- A C-90 Plan. OK, this one is only for planning functions. The broader workforce doesn’t use it. This plan is that if the burn stays the identical, however income comes up brief. You want this plan to know the way lengthy your money lasts if subsequent 12 months is more durable than deliberate. It’s pretty simple to construct as nicely. Take your C-60 plan, preserve the bills the identical, however lower the income, say, 20%. Watch your burn and your Zero Money Date go method up. Be sure to have sufficient money to assist this mannequin. Particularly nowadays.

OK, so that you want a comparatively high-quality plan — however that isn’t too laborious to make. It’s often not as laborious because it sounds. Begin with an “L4M” mannequin — a mannequin that simply averages the expansion fee in your income, your prices, and your burn fee for the final 4 months or so. And simply roll these common development charges ahead into subsequent 12 months. It’s that easy. Here’s how:

So in case your income is, say, rising 5% a month on common for the previous 4 months, burn fee going up 3% a month, and every particular person value space a various quantity — simply roll all of them ahead every month into the tip of subsequent 12 months. That’s the almost definitely situation — for now. Your C-60 Plan. Chances are you’ll do higher, chances are you’ll do worse. Nevertheless it’s typically a great base plan you possibly can put collectively in 10-Half-hour. And if it’s actually lacking some massive offers, some massive tendencies, and or massive prices — then make tweaks on prime of it.

Then, when you tweak the C-60 Plan a bit, and finalize it … then enhance the income as a lot as you possibly can in order that it’s nonetheless believable to hit (i.e., a ten%-20% likelihood to hit a better prime line). That’s your C-10 plan. Once more, that’s usually +20% on the income aspect, after which be sure to add within the prices. Now you may have your stretch plan.

And at last, construct your C-90 Plan. This one isn’t that enjoyable, however it’s simple to construct. Key all the prices from the C-60 plan above, and simply lower the income development by 20% or so. Your burn fee will usually go up about 20%-25% as nicely beneath this plan. And particularly in the event you don’t actually just like the C-90 Plan, a minimum of discuss it with the founders and the finance workforce. You’ll have to implement it. Lots of founders don’t actually just like the implications of their C-90 Plan and conceal from it, and even by no means construct it. That always results in tears.

The three plans you have to make as a founder:

The C10 Plan, The C60 Plan, and the C90 Plan: pic.twitter.com/JSPcjbfzpt

— Jason ✨👾SaaStr 2025 is Could 13-15✨ Lemkin (@jasonlk) October 4, 2022

Now you may have 3 plans — and three burn charges and Zero Cash Dates. Use the C-60 plan for the Base Plan and everybody’s targets for subsequent 12 months. The C-10 plan for the Stretch Plan and bonuses for everybody in the event you hit it. And the C-90 Plan to handle money.

And in the event you don’t like your money attain after this — determine what to chop, or how a lot to boost, that offers you 16+ months of runway.