For the reason that emergence of Bitcoin in 2009, the cryptocurrency market, though not secure, has been gaining momentum.

The expansion of the market was accompanied by large funding inflows, elevated curiosity from main enterprises, and naturally the emergence of a complete vary of latest belongings.

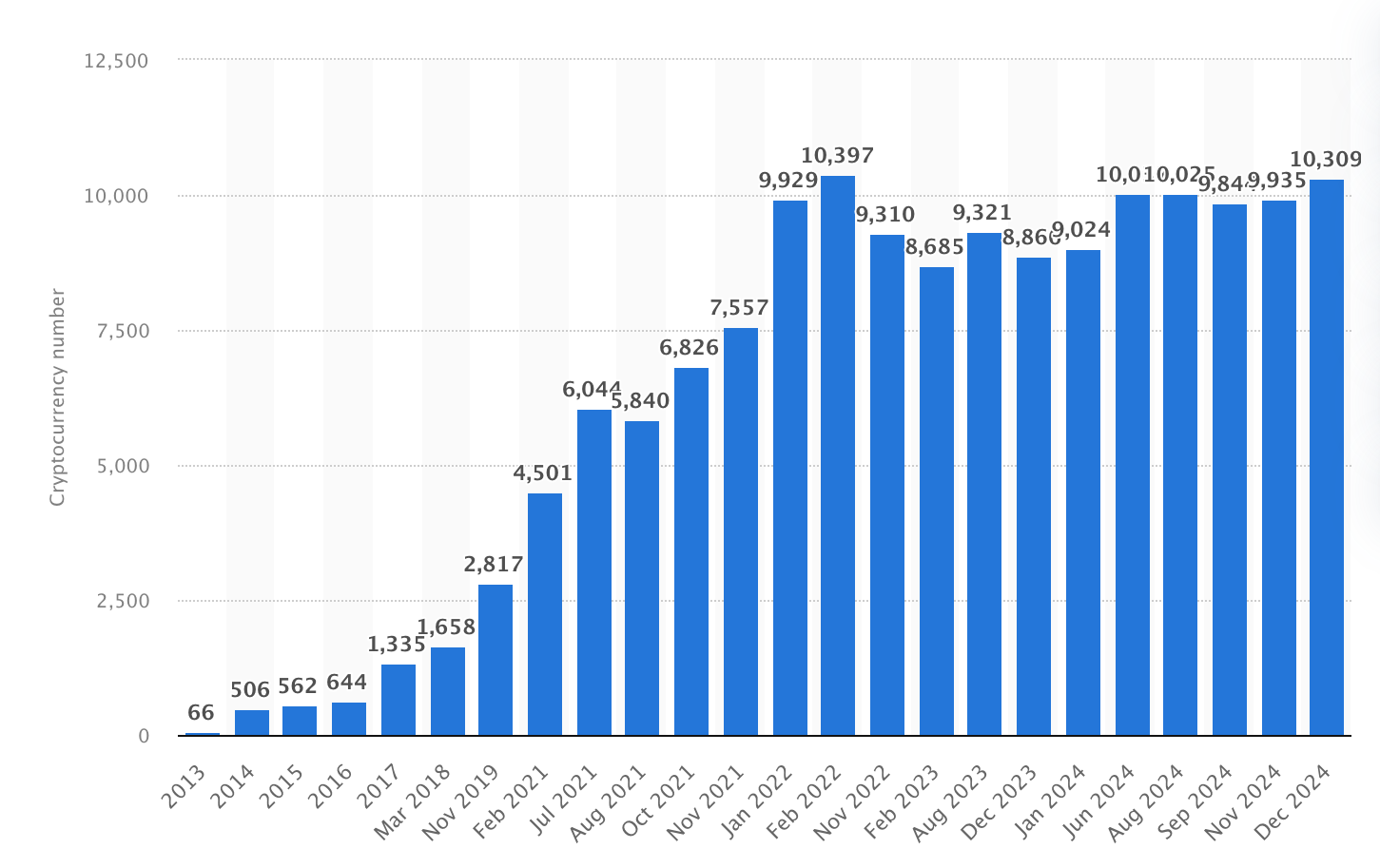

As of 2024, there are round 10,309 energetic cryptocurrencies on this planet. A big share of those cryptocurrencies, nevertheless, will not be that vital and fashionable amongst crypto house owners. And actually, only 20 cryptocurrencies form 90% of the market.

Nonetheless, for any personal particular person or firm cryptocurrency development can nonetheless be a worthwhile expertise. A brand new crypto unit may help type a novel digital neighborhood, increase or exchange conventional funds, provoke crowdfunding, and even tokenize bodily or digital belongings.

With the correct technique, even smaller initiatives can carve out a distinct segment out there and supply actual worth to customers.

On this tutorial, we’re going to break down what it takes to create your personal cryptocurrency: the method and use instances, issues and traps you would possibly face, and how one can overcome them.

What Is Crypto? Sorts of Crypto

Crypto, brief for cryptocurrency, is mainly a digital or digital asset that makes use of cryptography/encryption to guard transactions.

In contrast to conventional (state) cash, cryptocurrencies don’t depend upon banks or governmental institutions and are arduous to pretend or counterfeit. They run on decentralized networks, largely powered by blockchain know-how, and are a central element of the Web 3.0 ecosystem.

Apart from, crypto doesn’t discuss with any explicit asset. Crypto holdings usually fall into a number of varieties, the place some are made for getting and promoting and others are created for investing, voting, or governing communities:

- Cash: Cash run on their very own blockchains and are normally the first forex of that community. They’re largely used for transactions, storing wealth, or powering the system. The preferred representatives of cash are Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

- Tokens: Tokens, then again, don’t have their very own blockchain and are designed for particular functions inside decentralized networks. As an illustration, utility tokens give folks entry to explicit companies; safety tokens, in flip, are used to symbolize possession in an organization or asset; and governance tokens (Uniswap) enable holders to vote on crucial selections in decentralized alliances or protocols.

- Stablecoins: Stablecoins (Tether and USD Coin) are tied to fiat belongings (e.g., the US greenback) to protect their worth in case of market swings.

- Meme Cash: Similar to it sounds, these cash (e.g., Dogecoin or Shiba Inu) are sometimes primarily based on memes or web tradition. They don’t at all times have severe use instances however can earn recognition only for enjoyable.

Widespread Use Circumstances for Cryptocurrencies

Cryptocurrencies have many various makes use of past simply being traded or invested in. Listed here are among the hottest methods folks and companies use them:

Digital Funds

Cryptocurrencies are regularly turning into a traditional approach to make funds for numerous items and companies on the web, and even in retailers.

These fee techniques are comparatively sooner and cheaper in comparison with conventional techniques, particularly with worldwide transactions as they don’t require banks or fee processing corporations.

Cross-Border Funds

Conventional strategies to ship cash throughout borders usually take time and value so much. With cryptocurrencies, nevertheless, cash switch is far simpler and cheaper.

Sending funds through Ripple (XRP) or, let’s say, Bitcoin is extra instantaneous and prices much less, which will be helpful for companies or individuals who must recurrently ship a big quantity all over the world.

Funding and Buying and selling

Cryptocurrencies are extensively used for buying and selling and funding. Many purchase cash or different altcoins, hoping that their values will rise sooner or later. Cryptos will be thought of to be like investments (comparable to shares or gold) or be traded over a brief time period to make further revenue.

Good Contracts and Apps (DApps)

Cryptocurrencies additionally allow the implementation of sensible contracts—automated agreements the place the phrases are executed independently, which ensures a good margin.

Ethereum, in flip, additionally permits using dApps: decentralized functions primarily based on the blockchain to run, for instance, monetary companies or gaming websites with none central governing physique.

NFTs (Non-Fungible Tokens)

NFTs are digital certificates that denote possession of a sure one-of-a-kind merchandise, comparable to a bit of artwork, a soundtrack, or digital artifact. They are often acquired, offered, and traded by folks utilizing cryptocurrencies and may function a way of proving authenticity.

Decentralized Finance (DeFi)

DeFi employs cryptocurrency to offer a spread of traditional monetary companies but with out banks or different central establishments. DeFi continues to be a rising subject the place folks can use crypto to make curiosity or take out loans with platforms working absolutely on the blockchain.

Gaming and Digital Items

Most trendy video video games enable gamers to earn, buy, or barter skins or in-game rewards with cryptocurrency.

Regardless of all of the seeming insignificance, in-game gadgets have tangible worth; gamers can commerce them amongst themselves on totally different platforms and later convert earnings into fiat forex.

Charity and Donations

Cryptocurrencies are rising in popularity for donations attributable to their velocity and transparency, in addition to as a result of a donor can hint the place their contribution goes and see it’s being put to correct use.

Id Verification and Privateness

With rising considerations over private information, cryptocurrencies and blockchain can shield identities on-line. Blockchain provides folks the possibility to manage their info themselves and guarantee it’s protected when interacting with totally different digital companies.

Is It Authorized to Create Your Personal Cryptocurrency?

Producing your personal cryptocurrency—as with all software development services—is mostly authorized in most international locations, however there are necessary laws to concentrate on.

Whereas the act of making a cryptocurrency itself is just not prohibited, it’s essential to abide by myriad legal guidelines relying on the nation, the kind of cryptocurrency, and the way it’s used.

For instance, within the US and the UK, making a cryptocurrency is authorized so long as you comply with particular decrees concerning enterprise registration, taxes, and monetary laws.

In case your cryptocurrency capabilities like a safety or funding, chances are you’ll want to stick to securities legal guidelines.

Different important laws to concentrate to incorporate Anti-Cash Laundering (AML) and Know Your Buyer (KYC) guidelines, which forestall fraud and unlawful actions.

Moreover, tax legal guidelines could require you to report income from cryptocurrency actions, and shopper safety directives might apply in case your forex is utilized in transactions.

Some international locations, nevertheless, have banned cryptocurrencies altogether, comparable to China (nonetheless, the nation continues to have an energetic unlawful, underground crypto-mining sector)

Nonetheless, it’s important to analysis native pointers or higher seek the advice of authorized specialists as a result of, by the point you learn this text, chances are you’ll encounter vital modifications.

Methods to Make a Cryptocurrency

Producing a cryptocurrency is an thrilling problem, however the way you strategy it relies on your plans, funding, and technical background.

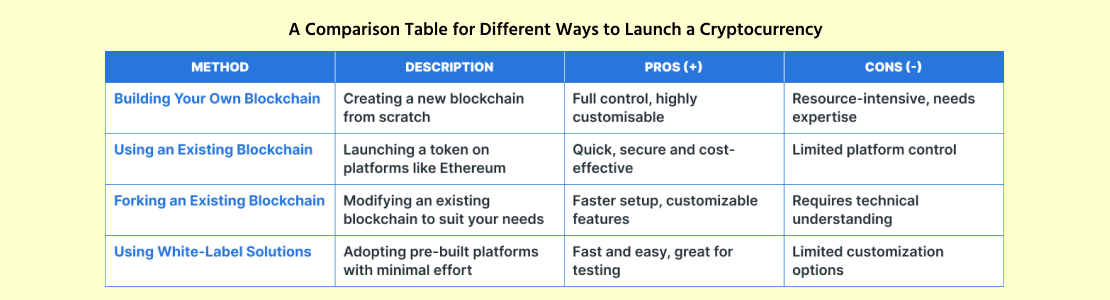

Construct Your Personal Model-New Blockchain Community

Constructing your personal blockchain means creating your entire system your cryptocurrency will run on. You’ll plan how transactions perform, decide how new cash are minted, and determine how the community will keep protected.

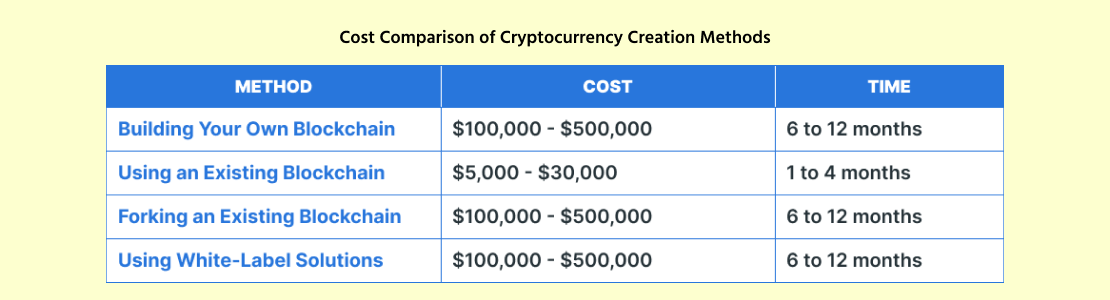

This strategy is the most costly choice, costing between $100,000 and $500,000 and taking 6 to 12 months or longer to perform. Apart from, you’ll want a workforce {of professional} architects, safety specialists, and infrastructure to arrange and run the blockchain.

The upside of making a brand-new platform is that you’ve got full management over each single a part of the system. The draw back, nevertheless, is its resource-intensiveness and profound technical know-how.

Use an Current Blockchain Platform

Need one thing sooner and extra inexpensive? Against the primary choice, you possibly can create a token on an current blockchain, comparable to Ethereum or Binance Good Chain.

This selection prices round $5,000 to $30,000 and will be achieved in simply 1 to 4 weeks as a result of the blockchain is already in place. All you want is a blockchain developer to develop and check the token and embed a sensible contact.

Thus, the advantages embody fast setup, low value, and utilizing a safe platform. Nevertheless, you don’t have a lot management over the platform itself and would possibly run into excessive transaction charges or platform limitations.

Fork an Current Blockchain

Forking means taking an current blockchain and making modifications to it to type your personal model.

This technique is far sooner than constructing a blockchain from scratch; on the identical time, you’ve got way more choices at your disposal, from how the blockchain processes transactions to what number of cash will ever be launched.

Forking can value wherever from $30,000 to $150,000 and may take about 3 to six months, relying on how a lot you wish to customise it. Apart from, you continue to want a talented workforce to direct the technical elements and infrastructure setup.

Whereas it’s much less work than constructing a blockchain from scratch, forking, nonetheless, requires a robust understanding of blockchain code and won’t profit from future updates to the unique blockchain.

White-Label Options

White-label options are pre-made platforms that mean you can swiftly produce a cryptocurrency with minimal customization. You buy the software program, customise the branding and a few options, and roughly that is it.

This selection is the most affordable and quickest, costing between $10,000 and $50,000 and taking about 2 to eight weeks to deploy. There’s little technical information required, as a lot of the work is already achieved for you.

The draw back is that you’ve got much less flexibility to customise your cryptocurrency, as you’re mainly utilizing a pre-made template. It’s an amazing choice when you simply need a easy, purposeful token or wish to check out the concept earlier than investing extra money and time into it.

Create a Cryptocurrency: Step-by-Step Course of

Making a cryptocurrency can really feel overwhelming, however breaking it into easy steps could make it simpler. Right here’s a transparent and concise information that will help you get began:

Determine Why You’re Making a Cryptocurrency

First, work out the aim of your cryptocurrency. Is it for quick funds? Powering a decentralized app? Fixing a particular downside? Having an in depth plan will steer the remainder of your actions.

Select How You’ll Create It

You may make your personal blockchain (nice for distinctive initiatives however takes time and sources), modify an current blockchain (sooner and fewer technical), or create a token on a platform like Ethereum (the only choice).

Decide How Transactions Are Verified

Select a consensus mechanism for verifying transactions. It may be Proof of Work (PoW), which is protected however energy-heavy, or Proof of Stake (PoS), which is quicker and extra eco-friendly. Keep in mind, the consensus mechanism will have an effect on how your cryptocurrency operates.

Plan the Options

Take into consideration the small print. What number of cash will exist? What safety features will it have? Will or not it’s quick and scalable? In case you’re making a token, comply with the platform’s instructions (e.g., Ethereum’s ERC-20 or ERC-721) requirements.

Design Your Cryptocurrency

In case you’re making a blockchain, you’ll want skilled architects to code it from the bottom up. For tokens, you simply want a sensible contract that describes how the token works.

Set Up Wallets

Individuals want wallets to build up and make the most of their cryptocurrency. You may make it suitable with fashionable wallets (like MetaMask) or construct a brand new one to match your undertaking’s calls for.

Take a look at All the pieces

Earlier than launching, run loads of exams to see if every little thing works. Check out transactions, examine for bugs, and ensure the system is invulnerable. Platforms like Ethereum provide check environments to assist with this.

Launch Your Cryptocurrency

Once you’re prepared, launch your crypto. Determine how one can get it to customers—by ICOs (preliminary gross sales), free giveaways (airdrops), or itemizing it on exchanges the place folks can independently commerce it.

Thoughts the Laws

Be certain that your cryptocurrency adheres to the legal guidelines in your goal areas, comparable to anti-money laundering (AML) guidelines or Know Your Buyer (KYC) laws. Full compliance helps keep away from authorized hassle later.

Promote and Maintain Bettering

After the launch, unfold the phrase about your cryptocurrency by social media, web sites, and partnerships. Construct a neighborhood of customers and hold updating your undertaking so as to add options and repair points.

Challenges in Cryptocurrency Growth and Overcome Them

After all, creating any cryptocurrency is thrilling, but it embodies its challenges. Understanding these issues is the important thing and answer to constructing a profitable and trusted cryptocurrency.

The most important impediment consists of quite a lot of technical difficulties that come up in making a cryptocurrency, particularly when it’s essential to create a brand new blockchain from scratch, which requires information of blockchain know-how, coding, and safety techniques.

Safety dangers are one other widespread downside. Cryptocurrencies and the platforms they run on are frequent targets for hackers. Weaknesses in sensible contracts, wallets, or the blockchain can result in large losses.

In keeping with the 2024 Crypto Crime Report, over $1.7 billion in cryptocurrency was swiped in 2023 ($3.8 billion in 2022)

To stop this, it’s best to focus on robust safety measures, comparable to systematic audits, updates, and hiring cybersecurity specialists.

Regulatory compliance stays one of many unresolved issues from 12 months to 12 months. Completely different states have totally different legal guidelines and views on digital belongings, and never obeying them can result in disastrous penalties.

To remain on the protected aspect, it’s very important to work with authorized specialists and by no means disregard Know Your Buyer (KYC) and Anti-Cash Laundering (AML) necessities.

Though to not the identical stage as earlier issues, scalability issues should still come up. When a number of folks begin utilizing it, gradual transaction speeds and excessive charges can discourage customers.

Selecting Proof of Stake (PoS) or second-layer options like sharding can visibly assist your system tolerate bigger volumes with out slowing down, nonetheless, it’s crucial to carry expandability beneath management.

Standing out in a crowded market will also be powerful. 1000’s of cryptocurrencies exist already, so drawing new customers will be almost unimaginable with out further monetary injections.

The least you are able to do to succeed is to give attention to creating one thing unique that solves actual issues.

Apart from, take note of pockets and change integration. With out compatibility with wallets like MetaMask or listings on main exchanges, customers would possibly discover it arduous to entry and commerce their cryptocurrency.

How A lot Does It Price to Create a Cryptocurrency?

The creation of a cryptocurrency will be pricey, however the associated fee relies on the kind of cryptocurrency you wish to create and the complexity of the undertaking.

In case you determine to create a token on an current blockchain, comparable to Ethereum or Binance Good Chain, it’s essentially the most cheap choice, usually costing between $5,000 and $30,000.

The primary work right here entails primarily establishing a sensible contract, which is comparatively easy and doesn’t require constructing a whole blockchain from scratch.

In order for you a customized blockchain—a totally new and distinctive system—the finances necessities will rise sharply. This may value wherever from $100,000 to $500,000, relying on how complicated the blockchain is.

Customized blockchains require extra growth work, comparable to designing the community, selecting a consensus mechanism, and including corresponding safety measures.

A big a part of the associated fee comes from hiring a growth workforce. You’ll want blockchain architects, safety specialists, and undertaking managers to plot and oversee the undertaking.

Builders usually cost $50 to $200 per hour, in accordance with their background and site. For a medium-sized undertaking, growth labor prices might vary from $20,000 to $100,000.

Including distinctive parts to your cryptocurrency, comparable to superior safety or sooner transaction speeds, will even improve the associated fee.

Primarily based on the capabilities you search, this might add between $10,000 and $50,000 to the whole. If you wish to create a cryptocurrency wallet, implement superior privateness options, or embed scalability options, then the value goes up additional.

Authorized recommendation and paperwork for the undertaking can value wherever from $5,000 to $25,000, relying on the place your cryptocurrency goes to be launched and the laws it should comply with.

Different main bills come from advertising and marketing and promotion. Nobody will learn about your digital forex with no good advertising and marketing effort, which might value upwards from $5,000 to $50,000 for a full-scale advertising and marketing program.

If you wish to checklist your cryptocurrency on main exchanges, be ready for itemizing charges, which might vary from $2,000 to $500,000 primarily based on the change you select.

From the launch of your cryptocurrency, there are different upkeep prices concerned. This may embody updates, safety checks, and buyer assist, with an estimated annual value between $10,000 and $50,000.

Total, the price of cryptocurrency creation companies can vary from a number of thousand {dollars} for a primary token to a whole bunch of hundreds for a completely customized blockchain with superior options.

It is very important consider your undertaking’s targets, options, and necessities very early within the growth stage to maintain prices beneath management.

Why Select SCAND for Cryptocurrency Growth Providers?

SCAND is an knowledgeable in cryptocurrency growth with over 20 years of expertise in software program and blockchain options. Our workforce develops customized cryptocurrencies, tokens, wallets, and blockchain platforms to match your wants.

We pay a lot consideration to safety and adherence to authorized norms to make your cryptocurrency correspond to worldwide requirements, comparable to KYC and AML.

Once you hire blockchain developers from SCAND, you get a workforce that retains in shut contact with a consumer, sustaining open strains of communication and adapting companies to suit the aim, finances, and timing of a undertaking.

FAQ

Do I would like blockchain experience to develop a cryptocurrency?

In no way. Once you work with a talented workforce like SCAND, they deal with all of the technical stuff, so you possibly can give attention to your corporation and objectives as an alternative.

What industries can profit from customized cryptocurrency options?

Just about any business! Cryptocurrencies could make a distinction in finance, healthcare, gaming, e-commerce, logistics, actual property, and extra by simplifying processes and serving to companies join with their customers.