In December 2024, the price of Bitcoin overstepped the $100,000 level following the designation of Paul Atkins because the director of the SEC (Securities and Trade Fee), who feels optimistic relating to blockchain and crypto property.

Nonetheless, a constructive angle in direction of crypto growth within the US and the remainder of the world after January 2025 could be in notable distinction to the previous.

Regardless of drawing a lot curiosity 12 months by 12 months, crypto all through its brief life stays vulnerable to dramatic rises adopted by equally instant falls.

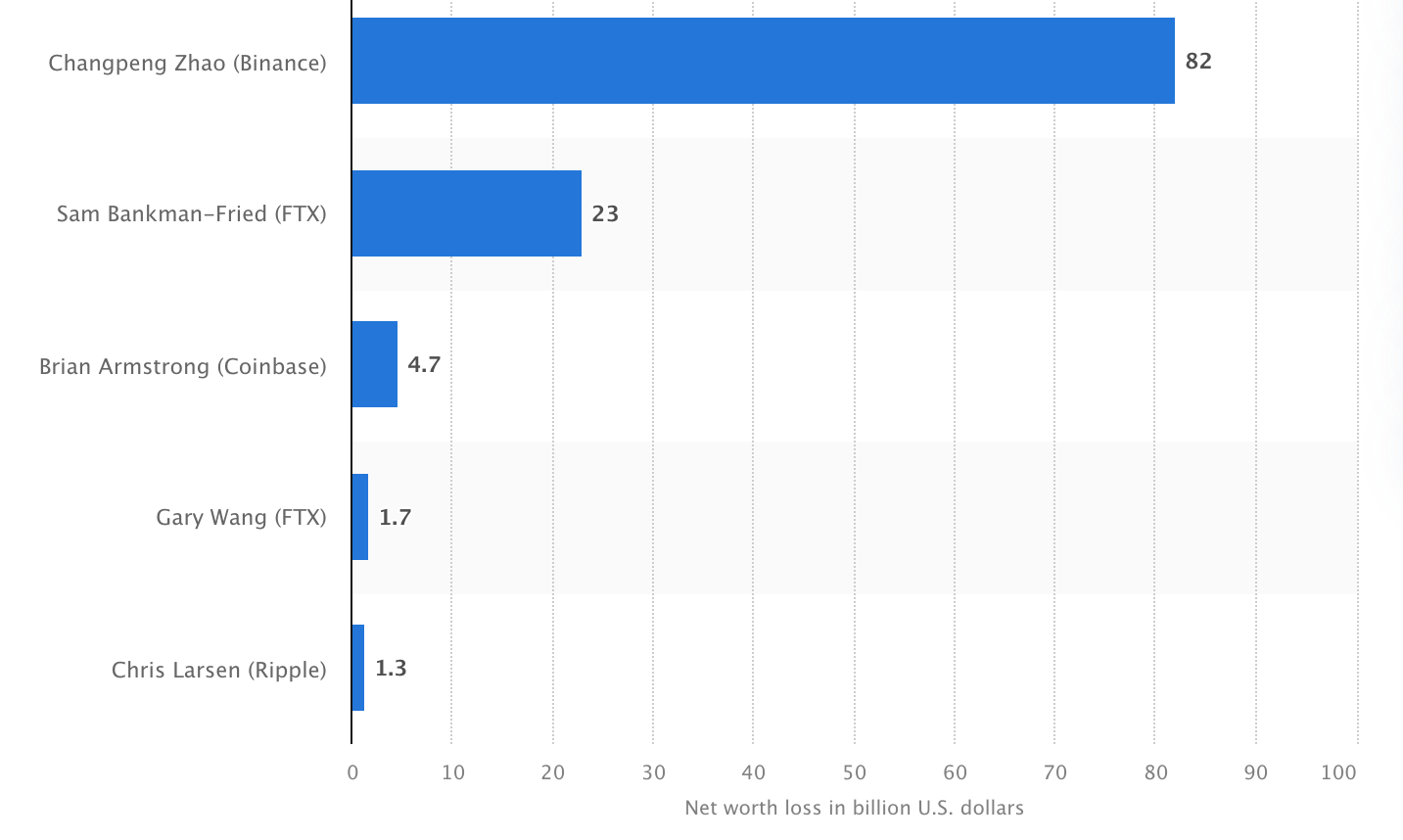

Simply have a look at the 2022 crypto crisis when Bitcoin fell beneath $30k and high crypto billionaires, similar to former FTX CEO Sam Bankman-Fried or Binance founder Changpeng Zhao, misplaced most of their capital.

Billionaires with the most important loss in internet value after cryptocurrency crash, Statista

Though investor confidence in blockchain currencies boosts once more, it received’t get any simpler to exist within the crypto world. The cryptocurrency market is fast-paced and operates 24/7, making it nearly unimaginable for merchants to observe and handle value actions unaided.

What Is a Crypto Buying and selling Bot in Blockchain?

A crypto buying and selling bot, for instance, a Bitcoin buying and selling bot, is an automatic blockchain software program program made by cryptocurrency development services to independently execute cryptocurrency swaps on behalf of merchants.

It applies predefined algorithms and methods to look at market actions, generate buying and selling alerts, and execute purchase or promote orders.

How Does an Automated Crypto Buying and selling Bot Work?

In easy phrases, a blockchain crypto bot resolution carries out the identical buying and selling job as a human dealer however with some peculiarities.

First, it gathers dwell details about the market: costs, buying and selling volumes, and traits from cryptocurrency exchanges by way of APIs. Typically, when there may be not sufficient present knowledge, the algorithm turns to previous market knowledge to foretell future value actions and establish possible choices for earnings.

When the blockchain bot has all the small print wanted, it begins inspecting them utilizing preprogrammed directions or pointers created by merchants. This process helps the bot determine whether or not it’s the proper time to purchase or promote a cryptocurrency.

If it decides it’s a promising alternative, it independently locations the required purchase or promote order on the change.

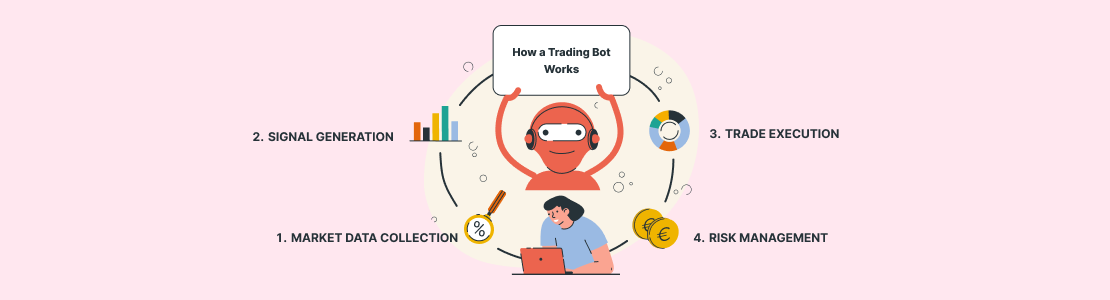

A scheme portraying how a buying and selling bot resolution works

It seems that the principle technique and conduct of the bot when acting on the change is about by individuals. Nonetheless, the power of the automated software program is that it completes all actions a lot sooner than a human dealer and, most significantly, impartially.

The blockchain bot additionally contains instruments to manipulate threat, similar to setting a most quantity of loss (stop-loss) or securing income when a particular goal is reached (take-profit).

Buying and selling robots additionally work unceasingly, with none breaks. They continuously watch the crypto buying and selling sphere, make selections, and commerce on an investor’s behalf.

On the similar time, you’ll be able to monitor the way it’s doing and make changes to its technique if wanted. This mix of automation and oversight makes crypto assistants a strong resolution for merchants.

Sorts of Buying and selling Bots

As a result of there are lots of buying and selling methods, there are lots of kinds of algorithms to go well with completely different funding kinds, functions, and market circumstances. These variations enable merchants to automate various approaches—arbitrage, market-making, pattern following, scalping, and so forth.

Arbitrage Bots

Arbitrage bots use value disparities for the precise asset on completely different exchanges. For instance, if Bitcoin is cheaper on Trade A than Trade B, the robotic buys it on A and sells it on B for a revenue.

Arbitrage scripts are extremely environment friendly to find minuscule and short-lived value gaps which might vanish in a break up second and require instant actions.

Market-Making Bots

Market-making robots examine income coming from the distinction between shopping for and promoting costs. They make simultaneous purchase and promote orders at a value above or beneath the market value to pocket tiny income in each transaction.

Such scripts would discover extra utility in low-liquidity marketplaces with extensive spreads however require being continuously fine-tuned to forestall losses in extremely risky circumstances.

Development-Following Bots

These automated instruments watch tendencies and execute orders on a market motion, within the upward or downward route. When the market strikes up, the blockchain bot executes purchase orders after which initiates promote orders if it signifies a downward pattern.

Development-following methods depend on technical evaluation indicators, similar to shifting averages or RSI, to acknowledge traits and generate alerts.

Scalping Bots

Scalping blockchain scripts are programmed to make small-scale trades that seem with minor actions in costs. These methods act higher in steady environments that transfer inside tight ranges. Whereas one commerce might return an insignificant revenue, the quantity accumulates with time.

Portfolio Rebalancing Bots

Portfolio rebalancing robots protect a sure allocation of property in a dealer’s portfolio. For instance, if the goal portfolio is 50% Bitcoin and 50% Ethereum, and by way of value modifications, it has shifted to 55%-45%, then the bot will promote Bitcoin and purchase Ethereum to repair the steadiness.

Sign-Based mostly Bots

Sign-based algorithms enter into the commerce on alerts from third-party or exterior media or platforms. These alerts might come from skilled analysts, algorithmic methods, or social sentiment investigation, permitting even beginner merchants to use high-end strategies.

Important Options of a Crypto Buying and selling Bot

In keeping with Coin Codex, the cryptocurrency market sees roughly $469B value of buying and selling quantity in 24 hours (on the time of writing, January 10, 2025).

Crypto buying and selling quantity as of 10.01.2025, Coin Codex

Crypto buying and selling quantity is likely one of the most significant metrics for assessing the present cryptocurrency economic system. To extract most revenue from a number of trades, it is vital that the bot is full of various growth options:

- Market Knowledge Analyzer: The blockchain bot resolution wants entry to dwell knowledge supplied by completely different platforms regarding costs, buying and selling quantity, traits, and even information or occasions which will affect blockchain property. With the data, it might make selections about when to purchase or promote.

- Sign Generator: The sign generator is the decision-making a part of the bot. It examines market information to pinpoint investing alternatives relating to predefined methods, together with traits or explicit patterns. In different phrases, when a sign (a purchase or promote alternative) is generated, the answer is able to act.

- Threat Administration Instruments: Threat administration options defend investments. They’re divided into stop-loss mechanisms which implies promoting a crypto asset when it reaches a sure degree of loss to restrict the injury; and take-profit, which refers to a approach to routinely promote a crypto asset at any given revenue goal in order that any good points are all the time locked in.

- Execution Module: The execution module sends the orders for getting or promoting to the change. This is likely one of the most vital components of the blockchain bot as a result of the crypto economic system strikes quick and a break up second can change the whole lot relating to value.

- Backtesting Capabilities: It’s vital to have a take a look at earlier than permitting any automated system to execute with actual cash. The backtesting function lets merchants simulate a buying and selling technique on historic knowledge. Meaning you get a glimpse of how the script would carry out if it had been an actual dwell run, thereby creating extra confidence.

- Customizable Methods: A few of the robots allow you to regulate or create your methods, be it buying and selling aggressiveness or technical indicators to make use of, similar to RSI or shifting averages.

- Multi-Trade Help: The potential for connecting the bot resolution to a number of exchanges is likely to be essential for extra superior merchants. Multi-exchange help will allow software program to behave concurrently on a number of platforms and reap the benefits of completely different conditions.

Why Each Crypto Dealer Must Strive Buying and selling Bot Growth Providers

One of many biggest advantages of automated robotic growth providers is that cryptocurrency exchanges are open 24/7 and require ongoing exercise.

In fact, it’s exhausting for any dealer to remain glued to the display screen all day and evening. Buying and selling blockchain scripts, in flip, are all the time able to act, even if you’re sleeping or busy with one thing else.

Automated software program can also be a lot sooner and extra correct than people. Crypto costs change shortly, and automatic methods could make trades in seconds, ensuring you don’t miss a possibility. They purchase or promote precisely when wanted, saving you from making delays that would break the bank.

One other vital benefit is that bots are emotion-free. When people commerce, worry or overexcitement can affect their selections and result in missteps—similar to promoting too early or holding on too lengthy.

Buying and selling blockchain assistants, nonetheless, don’t have feelings. They observe preset directions, which implies they commerce logically and impartially, with out being swayed by emotions.

Utilizing a buying and selling resolution may even prevent a substantial period of time. If manually carried out, it requires plenty of motion and focus to analyze the market and conduct trades. Automated scripts can run a number of trades alone, monitor manifold cryptocurrencies, and apply completely different techniques.

Additionally, automated scripts can commerce extra ceaselessly than people, which once more means they’re able to reap the benefits of small value actions many occasions a day. Even small income can add up over time, particularly with the quick modifications in crypto exchanges.

It’s also simple for inexperienced persons to begin with the assistance of a buying and selling software with none critical prior information. Most of those algorithms include easy interfaces and fundamental options to provoke the blockchain buying and selling exercise.

The right way to Create the Greatest Crypto Buying and selling Bot: A Fast Stroll Via the Growth Course of

Whereas constructing crypto software program would possibly sound like an enormous problem, a bit of know-how is certainly sufficient that will help you by blockchain bot growth providers and create a good resolution.

Clarify What You Count on from Blockchain Growth

Earlier than you create a bot resolution, it’s essential to know what precisely you count on your software program to do. Would you like a easy algorithm, like getting crypto when its value drops, or one thing extra superior, similar to following traits utilizing technical evaluation?

Gather Vital Information and Particulars

Now that you just perceive your preferrred, it’s worthwhile to get knowledge to show a blockchain robotic to make related selections.

Hottest crypto exchanges have APIs that allow you to seize costs, volumes, and traits. You pull this knowledge from these APIs and feed it to your algorithm so it should know precisely what’s going on.

Create the Buying and selling Algorithm

That is an important a part of blockchain growth and you’ve got two paths to create a bot. When your robotic digests the info, it must be correct to make purchase or promote selections.

When you really feel adventurous and have enough technical understanding, you’ll be able to create an answer your self. In any other case, you’ll be able to flip to a crypto trading bot development company, similar to SCAND, for assist and partly or fully delegate the undertaking.

Simply keep in mind—keep on with unsophisticated growth, particularly if you happen to’re simply beginning out. Don’t overcomplicate your enterprise till you get the hold of how automated software program behaves.

Set Up Threat Surveillance

For threat mitigation and profitable growth outcomes, create some stop-loss performance to assist decrease losses, in addition to take-profit orders so the bot resolution can lock within the good points.

Backtest Earlier than Going Reside

Backtest earlier than turning your software program program free with actual cash. It merely means pushing your system in opposition to previous knowledge to see how your software acts.

Most platforms enable for entry to historic knowledge to create an thought of whether or not your algorithm can succeed or not. There’s an choice additionally to make use of backtesting apps to show the buying and selling technique enforced inside your system makes correct predictions.

Activate and Watch Your Bot Resolution

While you’ve backtested and really feel assured in your resolution, it’s time to deploy it. Use small quantities of crypto initially, so to restrict your threat whilst you see the way it performs.

You must survey its exercise not less than for probably the most half. The circumstances on the change might change, and your software might have some tweaks to stay relevant.

Safe Your Software program

You don’t need anybody tampering together with your buying and selling resolution or accessing your account. Be certain to guard your API keys and keep away from hardcoding them in your blockchain bot code. A great growth follow is to make use of surroundings variables or encrypted information for storage.

Additionally, create dependable security mechanisms and allow Two-Issue Authentication (2FA) in your change account for added safety. This makes certain your script can’t do something and not using a second layer of safety.

Stipulations for Crypto Buying and selling Bot Growth

Blockchain bot growth mandates a little bit of preparation. There are some basic abilities, means, and setups you’ll want earlier than shifting on. Don’t fear, nonetheless, it’s not as overwhelming as it’d seem.

Technical Expertise Required

When plunging into blockchain growth providers, it’s essential to have some information of programming.

Python would be the programming language that it’s best to begin with because it’s simple to make use of and has a number of helpful libraries to create a feature-rich resolution, similar to pandas for knowledge manipulation, TA-Lib for technical evaluation, and ccxt for change API integrations.

Additionally, you have to to be taught in regards to the fundamental use of funding methods, buying and selling ideas, market orders, stop-loss, indicators, shifting averages (MA), RSI, and so forth.

Instruments and Frameworks for Blockchain Growth

When plunging into crypto buying and selling software growth, additionally, you will require some instruments and frameworks.

For enhancing your bot’s intelligence, use libraries from ‘pandas’ to ‘NumPy’. They’re fairly good for knowledge cleansing and knowledge evaluation.

Within the matter of devising methods, Backtrader is the best Python backtesting surroundings with historic knowledge. QuantConnect, in flip, is a cloud resolution with multi-language help.

To allow your algorithm to function round the clock, the best internet hosting choices are cloud suppliers, similar to Google Cloud, AWS, or Microsoft Azure. Nonetheless, if you happen to’re attempting to save lots of prices for small setups, go for DigitalOcean or Linode VPS suppliers.

And naturally, Git and GitHub are the required instruments for model management so to create and handle your code, work with different builders, and watch the modifications made in case you determine to change one thing.

Setting Up Accounts on Cryptocurrency Exchanges

To make use of your crypto buying and selling resolution, you’re required to create accounts on blockchain crypto exchanges. Begin with deciding on platforms that fulfill your standards (e.g., an array of supported cryptos, API performance, a buying and selling quantity, and so forth.).

When you find yourself prepared with the crypto change, register on the platform and full the KYC course of. Then, create the API keys that may enable your bot to entry change knowledge and execute trades.

It’s best to rigorously configure permissions, similar to imposing restrictions on withdrawals for added security.

Final however not least, learn by the API documentation of the chosen blockchain change as it should help with gathering the required info and finishing up automated trades.

Challenges and Dangers of Automated Bot Growth

Using a blockchain bot resolution within the cryptocurrency sphere may be affordable because it automates buying and selling actions. Nonetheless, there are dangers concerned.

Market volatility is a major concern inside the blockchain-based surroundings. A computerized bot might show to be worthwhile however whether it is unable to deal with sudden conditions it’s certain to incur losses.

One other hurdle if you create a bot is the robotic’s backtesting which generally overfits methods attributable to focusing an excessive amount of on previous knowledge.

Safety stays an issue 12 months by 12 months. As automated options rely upon using API keys to commerce in your behalf, mismanagement of these keys can expose them to hacking and put your cash in peril.

Server downtimes, change outages, and even crashes that have an effect on the API might intervene together with your script’s buying and selling capabilities and presumably trigger you to lose buying and selling prospects or execute a foul commerce.

Additionally, blockchain bots lack the human intuition of judgment, they can not reply as an example to breaking information and unexpected occasions {that a} dealer would, so you might generally should intervene manually.

Lastly, completely different international locations and jurisdictions allow completely different types of crypto buying and selling. This manner, it’s worthwhile to preserve abreast of regulatory modifications and return to the event course of to make vital amendments.

Greatest Methods and Means to Create and Run a Buying and selling Bot

Regardless of how great it’s, a blockchain bot resolution is only a software and it takes some effort to create it and preserve it unassailable, adjustable, and maintained.

To start with, safe your software program system by encrypting API tokens, using surroundings variables, and turning on two-factor authentication.

Additionally, don’t overlook to carry out common maintenance of your bot to ensure that it’s all the time in its greatest kind to adapt to market traits. You may all the time take a look at your program in a paper buying and selling mode to get all of the tweaks in place earlier than placing in actual cash.

There are different issues that may be performed. Considered one of them is to make use of a mixture of strategies and techniques to forestall enormous flops. This step may even assist throughout completely different swirls within the blockchain-based economic system.

Don’t forget to find out how rationally the buying and selling assistant features and evaluate its core parameters.

And final, with any new growth involving funding legal guidelines or taxes, we recommend all the time being up to date with the prevailing rules in order that your script doesn’t get you in hassle.

Attainable Instructions and Tendencies in Crypto Buying and selling Bot Growth

With the assimilation of synthetic intelligence and machine studying, it appears that evidently the period of automated software program software growth within the crypto buying and selling house will quickly method a brand new section.

The development of those developments will contribute to the betterment of the bots since they’d be capable to research the earlier trades made with a view to assist in foretelling future traits and enhancing self-directed methods.

With the rise of DeFi, in flip, there are alternatives for robots to begin interacting with decentralized exchanges and liquidity swimming pools, all searching for arbitrage alternatives.

Customization goes to be an enormous pattern too—future scripts will let you’ve gotten extra management over the technique design and execution. Moreover, superior parts, together with multi-signature wallets and decentralized authentication, will likely be added to the system, significantly growing the system’s safeness.

Correct threat administration, predictive analytics, and even sentiment detection will create a extra synchronized relationship with the blockchain economic system, in addition to the dealer’s buying and selling technique.

Verdict: Is It Value Turning to Crypto Bot Growth?

Crypto buying and selling algorithms are highly effective instruments that may assist merchants manipulate cryptocurrency trades extra rationally, moderately, and profitably. By understanding how they work and following a systematized method to create and handle them, you’ll be able to open new funding choices.

FAQs

How a lot does crypto buying and selling bot growth price?

Constructing a crypto buying and selling bot can vary in value relying on how difficult it’s and the options you need. When you’re constructing it your self, it might price wherever from a number of hundred to some thousand {dollars}. Utilizing open-source bots or white-label choices will likely be cheaper, with prices sometimes being a month-to-month subscription. When you go for an expert developer or managed service, count on to pay extra—wherever from a few hundred to some thousand a 12 months.

Can a newbie create a crypto buying and selling bot?

Undoubtedly! Even if you happen to’re a newbie, you’ll be able to create a easy buying and selling script. You’ll want a fundamental understanding of software program growth and a few fintech information. Loads of tutorials can information you thru the method. For extra superior methods, although, you might have to dive deeper. However if you happen to’re not into coding, you’ll be able to all the time select open-source instruments or managed providers as extra inexpensive alternate options.

Are crypto buying and selling methods worthwhile?

Crypto bots can positively earn cash, but it surely’s not assured. How properly your algorithm performs is determined by the techniques it makes use of and the way it handles the loopy crypto market. Bots excel in recognizing alternatives and making quick trades that people would possibly miss. However they’ll additionally lose cash if the blockchain-based economic system flips unexpectedly or the technique isn’t nice. Nonetheless, the proper growth method, testing, and common modifications will help you create an environment friendly software.

Are there any dangers to utilizing automated buying and selling software program?

Sure, there are dangers. Automated methods observe the foundations you create, but when the state of affairs goes wild, they won’t regulate like a human dealer. Safety is one other concern, particularly if you happen to haven’t carried out correct safety mechanisms through the growth course of.

Can I exploit a buying and selling bot resolution for decentralized exchanges (DEX)?

Sure! Buying and selling assistants can work on decentralized exchanges like Uniswap or SushiSwap. However they have to be tweaked to function on these platforms. Some automated scripts already help each DEX and centralized exchanges, so that you don’t have to create a brand new resolution and may commerce throughout a number of platforms.