In our put up “Buyer-Led Development and Product-Led Development: Buddies or Foes?” we focus on how the emergence of Buyer-Led Development (CLG) as a number one technique to gas sustainable progress requires carefully evaluating conventional roles and capabilities throughout the corporate.

Some pundits imagine that Skilled Companies (PS) not has a task in growth-oriented SaaS companies since little worth will be created with low-margin, non-recurring income. Others argue that Buyer Success (CS) is turning into out of date, as conventional CS is a caretaker – overhead that’s solely a luxurious within the age of worthwhile, environment friendly progress.

Main SaaS enterprises acknowledge the validity of each views and actively search methods to evolve their organizations, expertise, and providers to ship an unparalleled buyer expertise. This text delves into how fashionable SaaS corporations can revolutionize their method to skilled providers, aligning carefully with buyer wants and driving vital progress.

Unpacking Buyer-Led Development

Dave Jackson, a thought chief in Buyer-Led Development methods, printed a latest article, “Are CS Departments Facing an Existential Crisis?” In his article, he means that regardless of the large funding corporations have made in constructing buyer success capabilities within the type of groups of buyer success managers, buyer retention has not meaningfully improved. He argues that the self-discipline of buyer success is important, however the practices and construction many SaaS corporations make use of are failing. In flip, CS leaders are sometimes accused of being targeted solely on constructing massive organizations, blaming Gross sales and Product for churn, and shirking income duty by arguing that the act of promoting soils the shopper’s view of the CSM as a trusted advisor.

Buyer-Led Development is predicated on the premise that buyer success (small c and small s) must be the point of interest of the whole firm. Frank Slootman, former CEO of Snowflake believes, “When you’ve got a Buyer Success division, that provides everybody else an incentive to cease worrying about how properly our prospects are thriving with our services.” Extra importantly, typical success metrics like NRR and GRR must be tracked however are immaterial from a buyer’s perspective.

Jackson concludes, “The market shift in 2022 resulted in many shoppers canceling SaaS subscriptions and considerably elevating the brink for any new purchases. Those that survived usually had a easy benefit: they might present how they improved ends in metrics that mattered to the folks shopping for and utilizing their product. The widespread key to new buyer, retention and enlargement income was, and is, proving in measurable phrases, your worth to prospects.” [1]

With this premise in thoughts, you’ll be able to open the field and begin unpacking CLG and the way organizations throughout the corporate can align on buyer worth attainment of their initiatives and priorities. We wish to drill down right here on an often-forgotten a part of the enterprise and evaluation how Skilled Companies can contribute and the way your PS framework can evolve in right this moment’s market.

The Evolution of the Skilled Companies Enterprise Mannequin

The contribution of Skilled Companies to a software program firm from each a buyer acquisition/retention and monetary perspective has at all times been debated. How a lot non-recurring and dilutive income is an excessive amount of? How do an organization’s service choices compete with these of its channel companions? How ought to Gross sales be compensated for PS gross sales?

SaaS and the Impression on Skilled Service Fashions

By the top of 2023 , greater than 90% of worldwide enterprises have been counting on some type of hybrid (mixture of personal and public) cloud deployment. The market measurement of SaaS services grew greater than 19% to $145 billion in 2023.

Gartner [3]

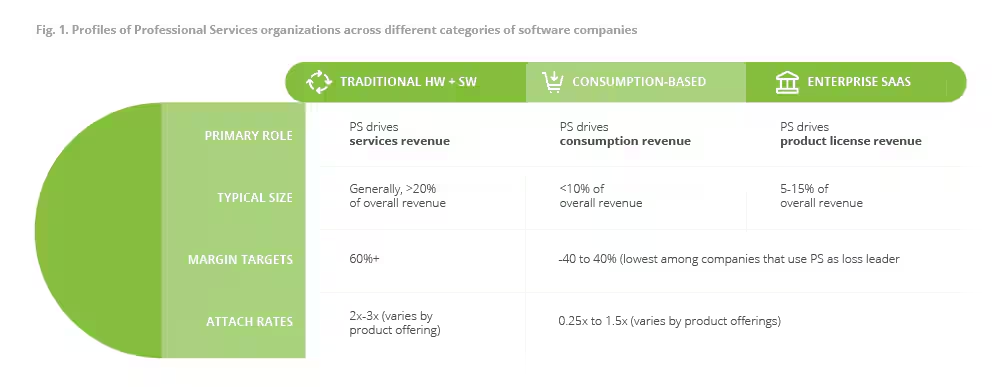

The evolution of SaaS has created a brand new dimension within the PS debate. Regardless of this shift to the cloud, conventional pc and community infrastructure corporations use skilled providers to drive income and increase their general income. Nonetheless, even well-established SaaS corporations are making significant sacrifices of income and revenue for the sake of leveraging PS to enhance the Annual Recurring Income (ARR). This pattern is much more pronounced, with hyper-scalers adopting the pay-as-you-go mannequin and utilizing skilled providers to draw new purchasers, even when it means taking a loss at first.

With the large shift towards cloud-based options, conventional skilled providers offers (product-led, project-based, implementation-oriented providers) have dwindled. Corporations are investing in new capabilities and repeatable, scalable choices to remain related. That is manifested in the truth that providers are being made obtainable in additional bite-sized, on-demand packages at decrease prices and with fast supply to satisfy altering product wants and buyer preferences.

These packaged providers are largely lumped into 4 classes.

- Visioning providers – targeted on understanding buyer wants usually throughout the gross sales course of to speed up gross sales deal velocity and tee up follow-on skilled providers engagements at increased worth and margins.

- Evaluation providers – assist prospects consider current-state know-how and tooling panorama and design SaaS- and consumption-based options that assist ship desired buyer outcomes.

- Migration and adoption providers – assist prospects deploy, combine, and configure options, migrate information, and go dwell sooner.

- Optimization providers – leverage utilization information to proactively work with buyer groups to construct hands-on product expertise, speed up adoption, automate enterprise operations, and form enterprise outcomes.

For instance, Splunk provides a variety of easy-to-use, pre-made providers like recommendation, setup, and coaching that prospects get once they purchase a product. They get credit often, which they’ll use to purchase particular providers (like creating a brand new dashboard) from Splunk’s service catalog to assist them succeed all through their product use. [4]

Leveraging Skilled Companies for Buyer-Led Development

The evolving function {of professional} providers organizations in SaaS- and consumption-based corporations implies that the traces between skilled providers, buyer success, and gross sales are sometimes blurred. Conventional efficiency measures and assumptions for PS organizations, like utilization, realization, and profitability, are inclined to create friction on this surroundings.

When you’ve got a Buyer Success division, that provides everybody else an incentive to cease worrying about how properly our prospects are thriving with our services.

Frank Slootman, former CEO of Snowflake

Prime SaaS corporations implement an efficient engagement mannequin that fosters collaboration amongst customer-facing service capabilities via incentives and broadens the function {of professional} providers as a catalyst in delivering desired buyer outcomes.

Software program as a Service (SaaS) and consumption-based software program corporations striving to spice up adoption and goal new market segments can leverage 4 strategic strikes spanning their worth chain, from technique improvement to product supply.

Set a transparent PS technique – If the objective is to leverage PS in attaining constructive buyer outcomes, this have to be said and understood clearly, however extra importantly metrics have to be aligned to make sure drive behaviors and set expectations throughout capabilities. This might imply measuring time to worth for PS engagements, long-term adoption, or buyer well being metrics and, from an operational perspective, probably having decrease utilization targets to account for time spent on adoption actions.

Develop Pre-Packaged Options – Proceed to refine the service providing portfolio by designing packaged options primarily based on the classes outlined earlier. The objective is to make PS straightforward for patrons to purchase and eat. Choices that construct upon one another in a sequence that maps to the shopper lifecycle will be very efficient in sustaining engagement and growing the probability of long-term adoption.

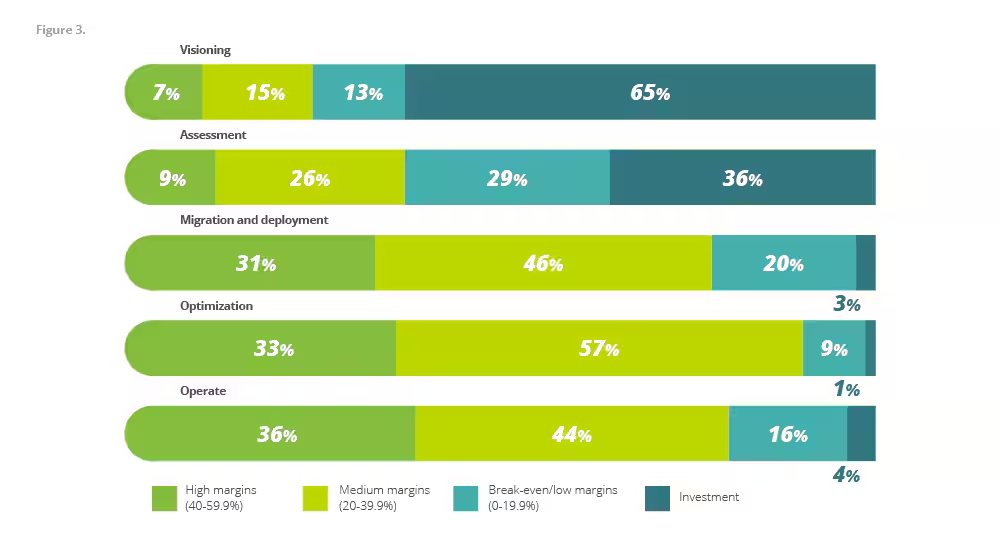

One other approach to enhance long-term engagement is to strategically worth these packages primarily based on the part of the lifecycle. A latest research by Deloitte confirmed that corporations are extra doubtless to offer visioning and evaluation providers as an funding or at break-even prices to achieve buyer mindshare. [2]

Introduce value-based pricing – value-based pricing will be leveraged in later-stage engagements with extra mature prospects to make up a few of the margin from investments made earlier within the engagement. In keeping with the Deloitte survey, a 3rd of corporations leverage value-based pricing in optimization and operational engagements.

Rethink expertise mannequin, expertise, and supply facilities – along with leveraging offshore labor swimming pools for price benefits, outsourcing or partnering with different service suppliers, leveraging contractors or gig economic system experience, and discovering methods to pool assets throughout organizational capabilities will enhance outcomes.

Conclusion

The views surrounding Skilled Companies (PS) and Buyer Success (CS) have undergone vital modifications lately. As some pundits query the relevance of those departments resulting from perceived low margins and overhead prices, main SaaS enterprises are innovating to redefine their roles in fostering Buyer-Led Development (CLG). The shifting dynamics between PS and CS spotlight the significance of evolving methods to ship unparalleled buyer experiences whereas aligning with broader enterprise targets.

Assets

- Dave Jackson, Buyer-Led Development Weblog “Are CS departments facing an existential crisis?“, January 2024

- Deloitte, Views, “Evolving role of professional services in software companies“

- Gartner, “Gartner forecasts worldwide public cloud end-user spending to grow 18% in 2023,” November 2022.

- Splunk, “Success plans,” August 2022.